How-To: Optimize your Taxes & Assess your House Value

Impact on the Assessment on your taxes

Welcome to the club of the happy home owners and tax-payers: as a home-owner, you are supposed to maintain your property but also pay additional taxes. Sure, you are happy to increase the wealth of your city and contribute to the well-being of your neighbors! But you might also want to avoid to give too much and keep some money to also treat your neighbor and buy them a beer and/or invite them for a party. So, you might consider to reduce the amount of taxes related to your property. In fact, the taxes you pay depend on various factors: the city rate, the value of your house, etc. And the more expensive the house, the more you pay. The city should provide you the assessment value of your home. In the Pittsburgh area, this is available online through the Allegheny County website. You might want to change the assessment value of your home: if you are selling it, you would like to increase it (it shows that the home is more expensive than what you are asking for) and if you stay in it, you might want to decrease its value (so that you pay less taxes).

Assessment Appeal Process

If you think the value of your property is not correct, you can request a new property assessment. Basically, you have to contact the county services that are responsible for evaluating your property value and make an appointment. The appointment is a hearing when you will explain why the value of the property might not be correct. For sure, you have to provide evidence and documents that support your argument.

The hearing takes place with a representative of the county service. You go in a room and the person records you. During the hearing, you have to provide as many details as possible but also provide three copies of each document that might be useful for evaluating your property value. Make sure you discuss all the different aspects that might be considered for evaluating your property value. Most evaluation criteria are:

- Buyer price: how much did you spend for this house? how long the house stayed on the market? show the history of the house: if it stayed a long time on the market, it shows that the house was likely overpriced.

- Potential Work: when buying the house, it might be in a very bad condition and require a lot of work. Of course, it means that the value was too high. So, when going to the hearing, you might want to take the inspection report you got when buying the house. It will then show potential defect that can be used to re-evaluate your house.

- School District: is the property located in a good school district? If yes, this might increase the value. Otherwise, it can lower the price. You can provide school ratings during the hearing to show the quality of your school district.

- Price of comparable houses: how much is your house compared to the one of your neighbors? Go on zillow, trulia or realtor to see what is the price of the house around you and how much they have been sold. If you also see a house that matches yours (in terms of description, specs, etc.), then, look at the price. If the house is on the market since a long time, it might means this is overpriced. During the hearing, take these comparable with you to show that comparable house are sold at a lower price than your assessment value.

- Crime Rate: if your property located in an unsafe area? if yes, it might be a good reason to decrease the assessment value! Go online, find crime rates for your neighborhood and bring the documents during your hearing.

Of course, you need to provide documentation to support your argument and explain why do you think the assessment value is not correct. Without it, there is no chance you can even get a re-evaluation: the county officer will have no proof that what you are saying is right. So, be specific, quick and efficient during your hearing.

Case-Study

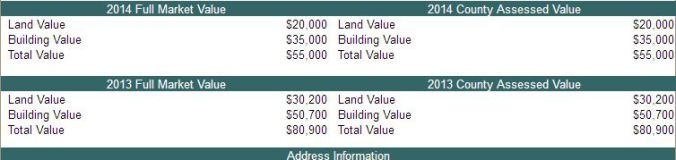

The method described below has been applied for a house in Pittsburgh, PA. During the hearing, the main points listed below have been discussed. Of course, all the documentation was also provided (history of the house on the market, renovation work, etc.). After the hearing, the assessment value was then re-evaluated (see below). Of course, this will then be used to re-evaluate the taxes for this property.